~~ written by AGelbert ~~

AGelbert • 10 hours ago • edited

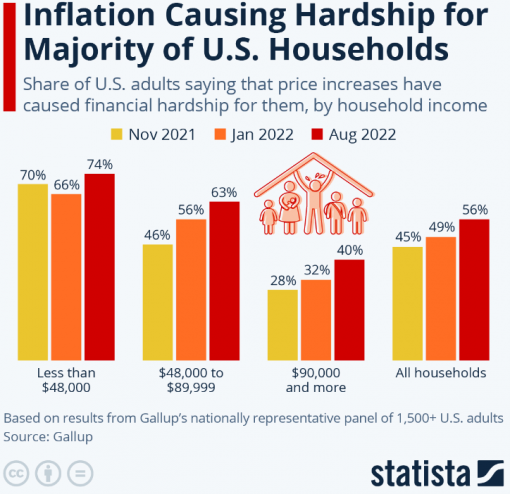

If the actual reduction in buying power since 1983 (when 😈 Greenspan gamed the CPI math in order to low ball the annual COLA adjustment to Social Security pensions EVERY SINGLE YEAR), all Social Security Pensions would need to ne increased by OVER 200%. That is the low end estimate. The more accurate number is 295% (see below), but doubling social Security, AND correcting the CPI formula to the reality based pre-1980 formula, would be a good start.

Of course, with the DUOPOLY running the socially destructive Wall Street worshipping "economy", I'm not holding my breath for that. Never mind the predictably evil Republicans, Capitalist Pelosi and her hand picked Chief of Staff 👿 Primus (a neoliberal, Wall Street worshipping sworn enemy of ANY improvement of Social Security and/or Medicare - which is why 🐍 Pelosi made him Chief of Staff), have consistently prevented ALL Bills improving Social Security from coming to the House Floor for a vote. This is the same Pelosi that talks out of the other side of her mouth by claiming she "cares" about we-the-people.

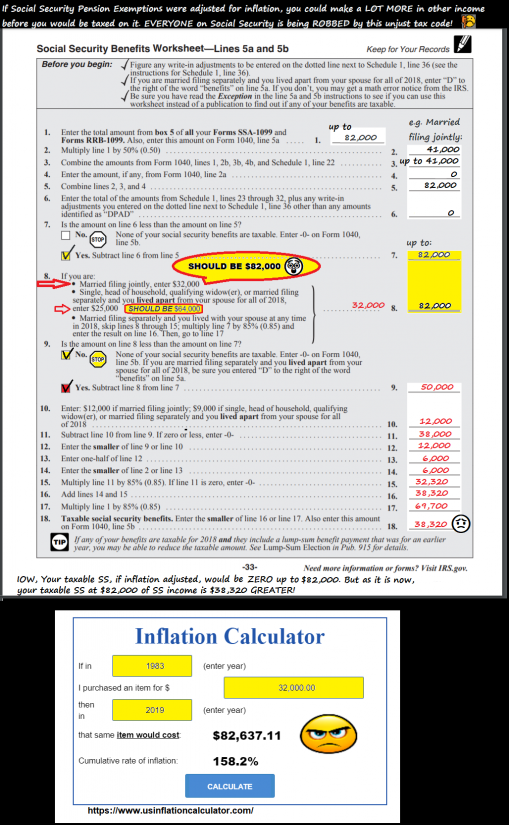

Here's the math. In a responsibly governed USA, ALL wages and pensions linked to the CPI to COLA increases would be increased by 298%:

FIRST, the, unfairly UNCHANGED SINCE 1983, Social Security taxabale income threshhold of $32,000. Above that you are taxed.

📢 Even with the low-balled COLA numbers, $32,000 1983 dollars EQUALS $95,155.34 in 2022 dollars! And THAT is just the unfair taxation part! The LOSS of buying power massively above and beyond the COLA "increase adjustments" since 1983 (i.e. 197.4%) add Government sponsored THEFT to the Government sponsored unfair taxation.

HOW? There are many, many goods and services we all require to live. They are NOT "luxuries". They are NOT "optional". THAT is what the Cost Of LIVING formula is supposed to be all about, but after Greenspan and his pals in the Federal Reserve corrupted the formula, is a Wall Street pleasing shadow of REALITY BASED COLA prior to 1980.

REALLY? HOW can that be? For the eye opening details on how we-the-people have been steadily defrauded, year after year, just check out the Chapwood Index and/or Shadow Stats.

In this post I will only point to one cost that affects everybody, whether they own a home or not. That cost is the Median Sales Price for New Houses Sold in the United States.

If you don't own, you have to rent. The more houses are valued at, the more you will end up paying for rent. Yes, food, water, clothing, transportation, etc. are all costs we cannot avoid, but the Chapwood Index 👍 will show you everything you need to know about that sine qua non basket of goods and services to evidence the FACT that 😈 BLS COLA numbers 👎 are ridiculously low-balled.

I bring up housing cost, because THOSE are even MORE 😈🎩 DELIBERATELY (see below) low-balled 😵 than those items I just listed.

Median Sales Price for New Houses Sold in the United States

SOURCE: https://fred.stlouisfed.org...

February 1983: $ 73,800

July 2022: $439,400

Do the REALITY BASED inflation math:

$439,400 - $73,800 = $365,600

$365,600 = [(365,600/73,800) x 100] = % increase of $73,800 = 495.4% INCREASE

📢 197.4% BLS CPI Published minus 495.4% PRESENT = 298% LESS than REAL INFLATION❗ 😡

The REAL INFLATION in the USA is Two Hundred and Ninety Eight percent MORE than the BLS published inflation. What that means for a person on Social Security is that they have been ROBBED of the 298% INCREASE they were entitled to had the BLS not Greenspan gamed the CPI "Owners Equivalent Rent" numbers to provide a "wealth effect" ILLUSION.

Yes, it is hard to believe, but for a Social Security pension of $1,000 a month in 1983 to have kept up with REAL inflation, it would now have to be $4,954 a month. YET, that $1,000 a month 1983 pension is at $1,974 a month. 🥺

For anyone that is getting cross eyed with the math, my point is that this example (which applies to ALL Social Security pensioners, more or less, but usually MORE SO) means that pension of $1,974 is getting SHORT CHANGED by $2,980❗

Now I hope you see why all Social Security pensions need to be DOUBLED, at MINIMUM, AND not subject to taxes below, at MINIMUM (i.e. using the BLS published 197.4% increase from 1983 to 2022 COLA numbers), any amount less than $95,168.

No comments:

Post a Comment